Taxes in WooCommerce can hail a lot of trouble, especially when it comes to exempting certain customers from tax. It may work for nonprofit organizations, tax-exempt entities, or just simply special groups of customers; manually configuring taxes is tedious and frustrating. This is where WooCommerce tax exempt plugins come into play!

These handy tools help automate the process, making it super easy to manage tax exemptions without the back-and-forth. No more manually adjusting tax settings or dealing with customer complaints about being overcharged. Just a smooth, hassle-free checkout experience!

With countless choices available, how do you decide? But worry not, for we’ve done all the hard work for you. In this post, we’re sharing 7 of the best WooCommerce tax exempt plugins that can simplify your tax settings. So, let’s begin!

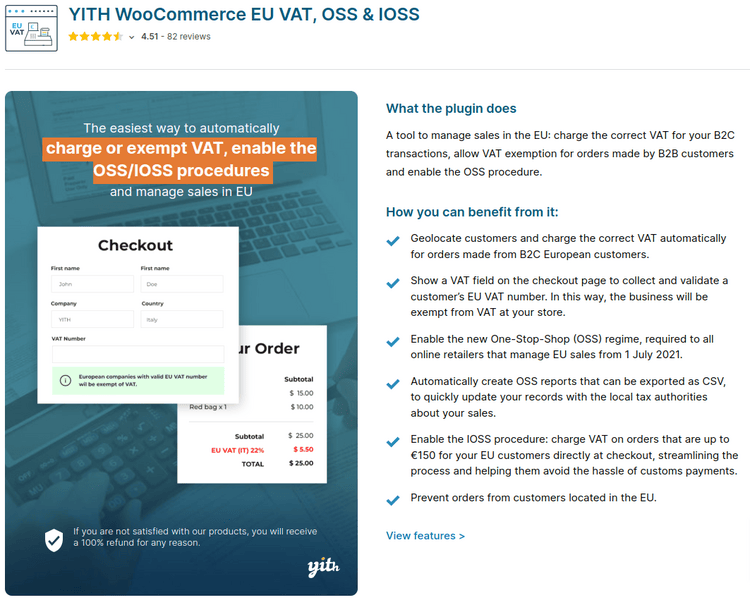

1. YITH WooCommerce EU VAT plugin

Handling EU VAT regulations can be a nightmare, especially with ever-changing tax rules. That’s where YITH WooCommerce EU VAT, OSS & IOSS comes in! The YITH WooCommerce EU VAT is one of the best sales tax plugin for WooCommerce. This powerful plugin automates VAT calculations, ensures compliance with the One Stop Shop (OSS) procedure, and makes tax reporting effortless.

With built-in geolocation, the plugin automatically detects your customer’s location and applies the correct VAT rate for B2C transactions. If you cater to B2B clients, businesses can enter their VAT number at checkout for exemption, streamlining the process.

You can also import all EU tax rates with a single click, monitor the €10,000 B2C sales threshold, and generate detailed tax reports in CSV format—perfect for keeping tax authorities up to date. Plus, if you want to restrict EU orders, you can block purchases from European customers in just one step.

Key features of this plugin are:

- The plugin automatically detects your customer’s location and applies the correct VAT rate based on their country. This ensures compliance with EU tax laws for every B2C order.

- Selling to businesses in the EU? Add a VAT validation field at checkout, allowing B2B customers to enter their VAT number and skip the tax—no manual approvals needed!

- Save time by importing all European tax rates in a single click. Plus, the plugin helps you track your €10,000 sales threshold for the OSS procedure, ensuring you apply the right VAT rates when required.

- Generate detailed tax reports based on your preferred schedule (monthly, quarterly, or yearly). And easily export them as CSV files to share with tax authorities.

Pricing– YITH WooCommerce EU VAT, OSS & IOSS is priced at $79.99 annually.

2. Tax Exempt for WooCommerce

Tax Exempt for WooCommerce lets you grant tax-exempt status to specific customers, user roles, or even guest users with ease.

Customers can submit exemption requests from their My Account page and track their status. For store admins, requests can be reviewed, approved, or denied; they can set expiration dates or choose to manually assign exemptions—all without any paperwork involved.

Admin can subscribe for customizable email notifications for approvals, denials, and expirations. Plus, tax exemption details are displayed on order pages, emails, and the admin dashboard for seamless tracking. If you are looking for custom email templates to suit your business brand, contact our WooCommerce development services.

Main features of Tax Exempt for WooCommerce:

- Let customers submit tax exemption requests directly from their My Account page and track their status in real time—whether it’s pending, approved, or rejected.

- This sales tax plugin for WooCommerce approves, rejects, or manually grants tax-exempt status to specific customers or user roles from the WooCommerce dashboard—no need for them to submit any forms if you prefer.

- Tailor the exemption form to collect the exact details you need. Plus, send automated email alerts to both customers and admins when requests are submitted, approved, or expired.

- Tax exemption details automatically show up on order pages, customer invoices, and emails, making record-keeping and tax compliance effortless.

Pricing– Tax Exempt for WooCommerce plugin is costs $59 annually.

3. EU/UK VAT Validation Manager for WooCommerce

Managing VAT exemptions for EU and UK customers can be tricky, but EU/UK VAT Validation Manager for WooCommerce makes it seamless. This plugin collects and verifies VAT numbers in real time, ensuring compliance while automating tax deductions for eligible customers.

A VAT field can be added to checkout and signup forms, allowing customers to enter their details. This sales tax plugin for WooCommerce plugin then cross-checks VAT numbers using VIES services to determine validity. You decide whether to remove VAT, preserve it for certain countries, or apply it based on billing and shipping details.

Notable features of EU/UK VAT Validation Manager for WooCommerce:

- Customers can enter their VAT number at checkout or signup, and the plugin instantly verifies it using VIES services, ensuring accuracy without delays.

- Choose how VAT is handled for valid numbers: remove it completely, keep it for certain countries, or adjust it based on shipping and billing details—you’re in full control.

- Personalize the VAT field’s label, placeholder, and description, control its position on checkout pages, and even set when it’s required or optional for different countries or user roles.

- Easily track VAT details with a dedicated meta box in order pages, a VAT column in the admin order list, and detailed validation logs to monitor all exemption events.

Pricing– EU/UK VAT Validation Manager for WooCommerce is available for free. Its premium version starts from $4.97 monthly.

Looking to create custom tax WooCommerce from scratch?

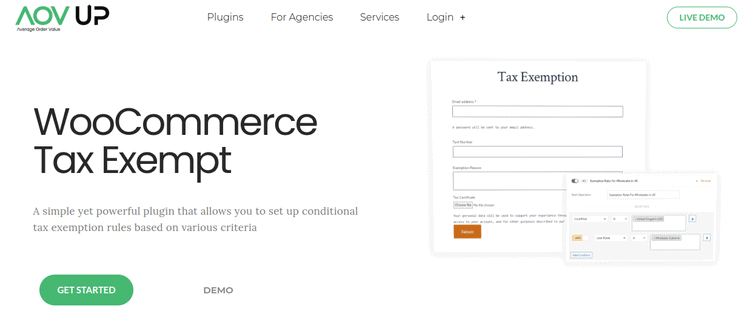

Explore our WooCommerce plugin development services4. WooCommerce Tax Exempt by AOV UP

WooCommerce Tax Exempt by AOV UP gives you complete control over how and when tax exemptions apply, ensuring a smooth experience for both you and your customers.

With this plugin, you can create tax-exempt coupon codes, allowing discounts that automatically remove tax when applied. Want different users to see prices with or without tax? No problem—customize tax-inclusive or exclusive pricing based on user roles. You can even override price suffixes for different customer groups to keep pricing clear.

For a more advanced setup, this sales tax plugin for WooCommerce plugin supports tax certificate uploads during registration (when used with a user registration plugin), ensuring proper verification. Plus, with targeting rules, you can apply exemptions based on country, user roles, products, or categories.

Key features of WooCommerce Tax Exempt by AOV UP:

- Create coupon codes that automatically remove tax when applied, making it easy to offer exemptions without manual approvals.

- Choose whether prices show with or without tax based on user roles, ensuring the right pricing visibility for different customer groups.

- Apply tax exemption rules based on country, user role, product, or category, giving you full flexibility over who qualifies.

- When used with a user registration plugin, customers can upload their tax certificate and number during sign-up, streamlining the exemption process.

Pricing– WooCommerce Tax Exempt by AOV UP is priced at $16.4 monthly (billed annually).

5. WooCommerce Tax Exempt by IgniteWoo

WooCommerce Tax Exempt by IgniteWoo lets you grant tax-exempt status to specific customers or user roles with ease. Whether you’re handling exemptions for nonprofits, resellers, or other tax-free buyers, this plugin gives you full control.

You can set tax exemptions on a per-customer basis, optionally recording their tax ID for reference. Need exemptions to expire after a certain period? No problem—you can set expiration dates to keep things organized. This sales tax plugin for WooCommerce plugin also allows partial exemptions, letting you apply tax-free status only to specific tax types instead of removing all taxes.

Features of WooCommerce Tax Exempt by IgniteWoo:

- Easily mark any customer as tax-exempt and keep their tax status saved in their user account for future purchases.

- Need temporary exemptions? Assign an expiration date to automatically remove tax-free status when the time comes.

- Don’t want to remove all taxes? Choose to exempt only certain tax types, giving you more control over how exemptions are applied.

- Assign different tax classes based on customer type, ensuring that each buyer gets the correct tax treatment without manual adjustments.

Pricing– The WooCommerce Tax Exempt by IgniteWoo starts its pricing from $59.

6. Tax Exemption for WooCommerce

Tax Exemption for WooCommerce makes it effortless for eligible customers to claim tax-free status at checkout—no complicated setup required.

Once installed, you can enable or disable tax exemptions, choose the tax class for exemptions, and even decide where the exemption fields appear on checkout and My Account pages. Customers can then check the “I want to claim tax exemption” box at checkout and enter their details. If valid, taxes are automatically removed from their order—including shipping if you allow it.

Notable features of WooCommerce EU & UK VAT Numbers Validation:

- Customers can simply check a box at checkout and enter their exemption details, making the process quick and hassle-free.

- Choose where tax exemption fields appear, whether on the checkout page, My Account page, or both, giving customers easy access.

- Customize text, labels, and messaging with your store branding. Provide easily digestible instructions to authoritarian-timed buyers.

- Tax will automatically be deducted from the order of the buyer’s exemption such as shipment (if enabled), thus ensuring a clean and sleek checkout option.

Pricing– Tax Exemption for WooCommerce is available for free. Its premium version starts from $59 annually.

7. Avalara AvaTax for WooCommerce

Avalara AvaTax for WooCommerce takes away the stress associated with tax rates, exemptions, and filings. Selling locally or internationally, the plugin automates tax compliance so merchants can focus on growing their business.

Real-time tax and duty calculations give your customers accurate total amounts at checkout—no unexpected fees or delays. Supports VAT calculations for B2B and B2C sales for seamless cross-border sales in the EU.

Digital exemption certificate management provides the functionality for tax-exempt buyers to automatically collect, verify, and apply exemptions, keeping everything organized. When filing time comes, Avalara works directly with state and local tax authorities to handle the filing and remittance process for you.

Notable features of Avalara AvaTax for WooCommerce:

- This sales tax plugin for WooCommerce plugin automatically calculates import taxes and customs duties at checkout, ensuring customers see the full cost upfront.

- Supports B2B and B2C VAT calculations for domestic and cross-border transactions, making international expansion smoother than ever.

- Collects and applies tax exemptions at checkout, stores certificates digitally, and helps you track everything effortlessly.

- No more manual tax filing! Avalara handles filing and paying your taxes with state and local governments, saving you time and reducing errors.

Pricing– Avalara AvaTax for WooCommerce is available for free to download.

Wrapping Up!

Tax exemptions in WooCommerce don’t have to be a hassle. The right plugin can automate exemptions, simplify compliance, and save you time. Whether you need VAT validation, exemption management, or custom tax rules, there’s an option for you.

Skip the manual work—choose a plugin, set it up, and focus on growing your business while it handles tax exemptions for you!